Australia’s journey towards becoming a global leader in low-emissions technologies hinges significantly on its hydrogen production capabilities. The recently released National Hydrogen Strategy by Federal Climate Change and Energy Minister Chris Bowen marks a crucial update to the original vision, established in 2019 by then Chief Scientist Alan Finkel. This revised strategy aims not only to establish Australia as a vital exporter of “green” hydrogen—produced using renewable energy—but also to make its production economically viable on a large scale. However, while the intent is strong, numerous challenges and uncertainties remain, potentially threatening the strategy’s executed ambitions.

The Promise of Green Hydrogen

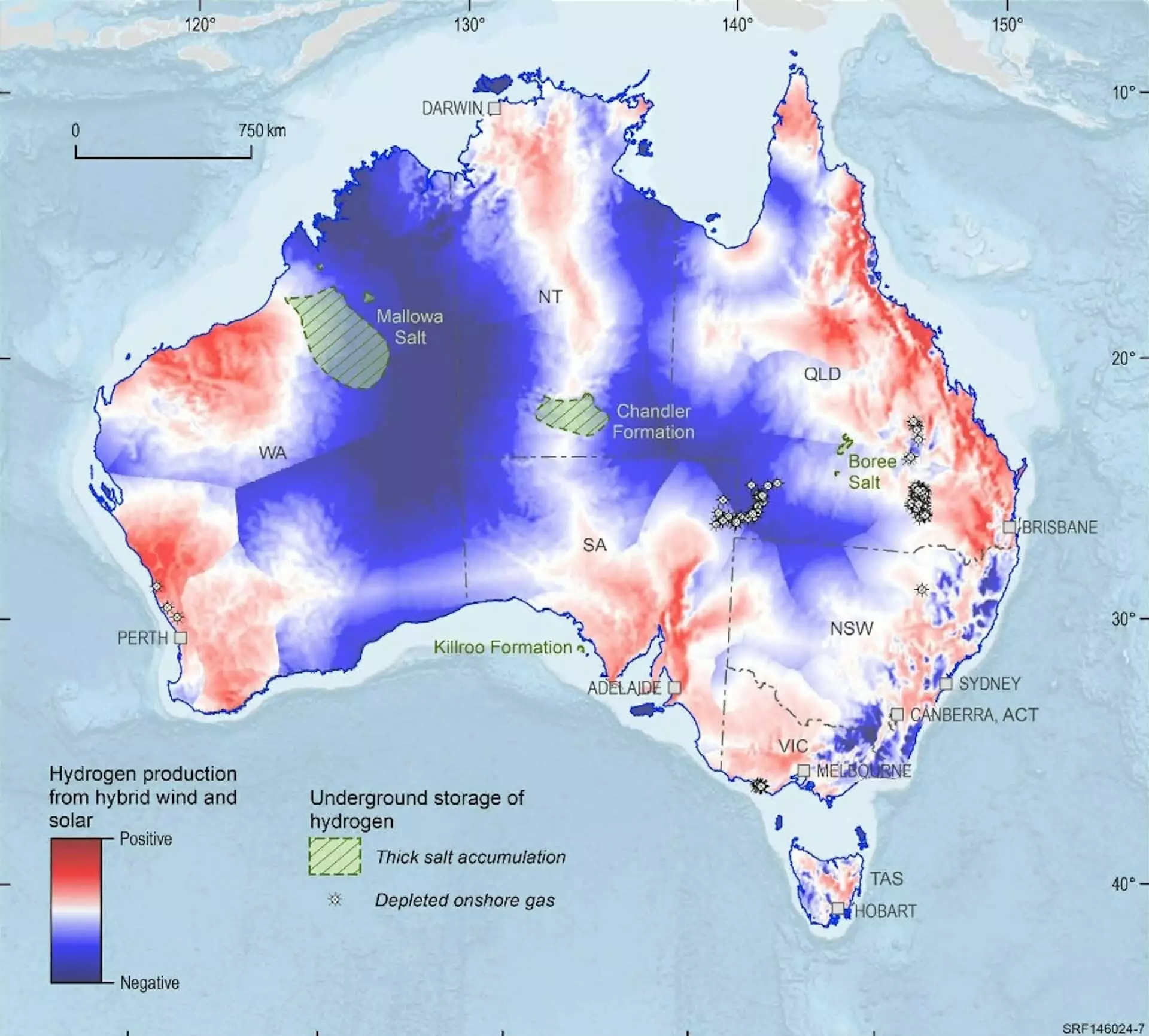

Hydrogen, the universe’s simplest and most prevalent element, holds immense potential as a clean energy carrier. Traditionally, hydrogen is leveraged in manufacturing sectors, including fertilizer and plastics, and proponents view it as a viable replacement for fossil fuels in industries like steel and chemical manufacturing. Moreover, hydrogen can function as a robust form of energy storage, making it an appealing candidate for managing domestic electricity supply issues in the future. In a world striving for sustainability, Australia possesses the unique opportunity to harness its renewable energy resources to elevate hydrogen production from its current infinitesimal levels to a competitive market player.

Yet, the ambition to catalyze a hefty green hydrogen ecosystem faces practical hurdles. A primary bottleneck is the cost of production, which currently exceeds market tolerance. The newly set production targets of 500,000 metric tons per year by 2030 and an ambitious 15 million metric tons by 2050 require significant scaling-up of operations—the effectiveness of which hinges heavily on strategic investments, regulatory support, and innovative technological breakthroughs.

The latest strategy proposes scaling the production of green hydrogen to meet specific targets, including “stretch” goals that challenge the status quo. This approach eliminates previous government expectations that underestimated the complexities involved in the storage and transportation of hydrogen as well as the transition to clean hydrogen-compatible technologies. However, ambitious targets alone will not yield results; a robust framework that guides investment decisions and builds market confidence is necessary for this vision to transform into reality.

The document identifies promising sectors like iron, alumina, and ammonia for potential integration of hydrogen technology, while it recognizes the need for exploring hydrogen’s contributions in aviation, shipping, and freight transport. This critical analysis reflects an evolving understanding of hydrogen’s role as the sector matures but leaves unanswered questions regarding how policy will prioritize these target industries over others. Will there be preferential funding, for instance, or will governments withdraw backing from non-competitive projects proactively?

An intriguing development within the National Hydrogen Strategy is its shift in focus from Asian markets, primarily Japan and South Korea, to European buyers, signaling a key change in Australia’s marketing strategy. This pivot is reinforced by initiatives such as the potential $660 million joint venture with Germany for securing markets for Australian hydrogen, highlighting the shift towards more competitive international landscapes. However, companies need to remain cognizant of hydrogen’s transport challenges—future decisions on export opportunities must balance expenditure and practicality.

Despite highlighting safety concerns—a legacy from the 2019 strategy—the updated document notably adds to the narrative surrounding prospective community benefits, such as job creation and regional economic diversification. This is particularly crucial in ensuring stakeholder engagement, especially from First Nations communities.

The effectiveness of this hydrogen strategy will hinge upon the government’s commitment to fostering a supportive climate for investment and innovation, including tax credits and grants aimed at production initiatives, such as the recently announced $2 billion Hydrogen Headstart program. However, concerns remain that these financial incentives may only benefit less viable projects without strategically aligning with national priorities.

As the hydrogen landscape unfolds, the effectiveness of the National Hydrogen Strategy will be assessed through various metrics, such as the attraction of investment to large-scale projects, binding contracts with hydrogen suppliers, and strategic commitments from domestic industries to transition away from fossil fuels. If these indicators do not materialize, Australia may be compelled to reassess its ambitions within the evolving hydrogen economy.

Ultimately, while Australia has outlined an ambitious hydrogen trajectory with the potential to reshape its energy landscape, the interplay of policy, market dynamics, and societal implications will critically influence the realization of this vision. The road ahead is fraught with challenges, but with the right concerted efforts, Australia could assert itself as a formidable player in the global low-emissions technologies arena.

Leave a Reply

You must be logged in to post a comment.