Uber Technologies Inc. has been a significant player in the ride-sharing industry, often positioned as a barometer for consumer mobility trends and broader economic sentiments. Recently, the company reported its fourth-quarter results, presenting a mixed bag of achievements alongside concerns that influenced a considerable drop in its stock price during premarket trading. In this article, we will delve deeper into Uber’s performance, dissect its earnings report, and analyze the potential implications for the company ahead.

On the surface, Uber’s fourth-quarter earnings exceeded analysts’ expectations concerning revenue, signaling robust sales and consumer demand. The reported earnings per share were an impressive $3.21, far surpassing the anticipated 50 cents. Similarly, revenue showed a compelling increase, hitting $11.96 billion compared to predictions of $11.77 billion. The company also experienced a remarkable year-on-year revenue growth of 20%, rising from $9.9 billion in the same quarter last year.

However, much of this net income—reported at $6.9 billion—can be attributed to extraordinary one-time benefits, including a substantial $6.4 billion tax valuation release. This context is crucial as it raises questions about the sustainability of Uber’s profitability in the regular terms of business operations. Despite a positive revenue trajectory, there remains a shadow over the financial stability driven by reliance on such non-recurring income sources.

When examining Uber’s operational segments, a more granular view reveals both progress and challenges. The Mobility segment generated $22.8 billion in gross bookings, indicative of an 18% increase year-over-year, while the Delivery segment also matched that growth trajectory with $20.1 billion. Notably, the Mobility revenue increased to $6.91 billion, outperforming the expected $6.77 billion, which showcases a strong demand rebound post-pandemic.

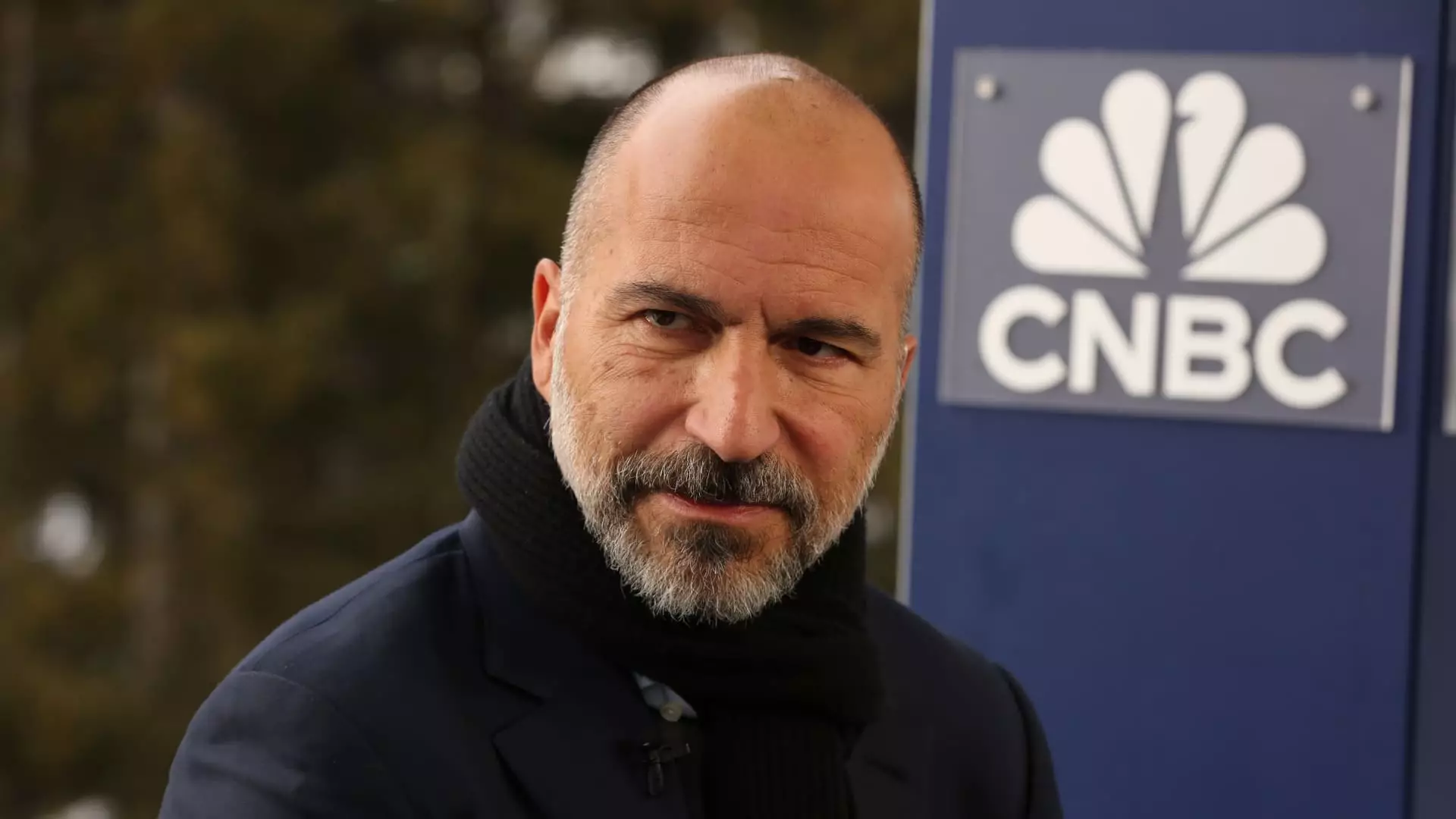

Conversely, the freight segment exhibited stagnation, raking in $1.28 billion—matching last year’s figures but falling short of expectations. This portion is particularly telling as it suggests a shift in consumer spending patterns, which have tilted toward experiences and services rather than physical goods transport. CEO Dara Khosrowshahi has identified this trend as a pressure point for the company, underscoring the competitive challenges within the logistics sector, especially as the economy evolves.

Despite the impressive past quarter, Uber’s forward guidance has introduced a note of caution. The company anticipates first-quarter gross bookings in the range of $42 billion to $43.5 billion, slightly below the consensus estimate of $43.51 billion. Similarly, the expected adjusted EBITDA of $1.79 billion to $1.89 billion casts doubt on the company’s momentum, especially in light of investor expectations.

Innovative aspirations are prevalent within Uber’s narrative, with announcements of public robotaxi services in partnership with Waymo beginning in Austin, Texas. This venture into autonomous vehicle transport could catalyze Uber’s growth in a new direction, reducing reliance on human drivers and potentially lowering operating costs. Yet, the success of such technology heavily depends on regulatory approval and consumer acceptance, both of which can be difficult to gauge.

While Uber has showcased robust performance in revenues and user engagement during the fourth quarter, particularly illuminated by innovative strategies and market adaptability, the company finds itself at a crossroads. The sporadic nature of its profitability, heavily impacted by non-operating income, coupled with mixed guidance for the upcoming quarter, creates a complex landscape for investors. Ultimately, as new market dynamics continue to shape consumer behaviors and technological feasibility, Uber’s ability to navigate this evolving terrain will be critical in maintaining its status as a leader within the rapidly changing mobility ecosystem. Observers will have to wait for further developments, especially relating to the integration of autonomous vehicles, to fully assess the efficacy of Uber’s strategic plans moving forward.

Leave a Reply

You must be logged in to post a comment.