The anticipation surrounding Nvidia’s forthcoming earnings report portrays a confluence of excitement and apprehension. Scheduled for release on Wednesday, after the market’s closing bell, this report holds significant weight, not just for Nvidia but for the broader technology sector and the evolving landscape of artificial intelligence (AI).

The Financial Forecast: High Expectations and Stellar Growth

Analysts have established a consensus estimate for Nvidia’s fourth-quarter performance that reflects robust growth metrics. Expectations are set at an adjusted earnings per share (EPS) of $0.84, coupled with expected revenues rounding to approximately $38.04 billion. Such figures represent a staggering forecast of 72% revenue growth in comparison to the same quarter last year, contributing to a projection for the full fiscal year that would see revenues more than double—nearly hitting $130 billion. The remarkable ascent of Nvidia’s financial profile is indisputable and is intricately linked with its prominence in the AI hardware arena, particularly with its data center graphics processing units (GPUs), which serve as the backbone for developing cutting-edge AI applications like OpenAI’s ChatGPT.

This surge can partly be attributed to the ongoing AI revolution, which has propelled Nvidia to unprecedented heights, with its stock price skyrocketing over 440% over the past two years. Notably, there have been instances where Nvidia’s market capitalization has eclipsed $3 trillion, solidifying its status as one of America’s most valuable companies. However, despite this meteoric ascent, recent months have seen Nvidia’s stock stabilize, returning to price levels reminiscent of October last year. This stagnation prompts critical questions regarding the company’s future growth trajectory and its ability to maintain its current standing amid shifting market dynamics.

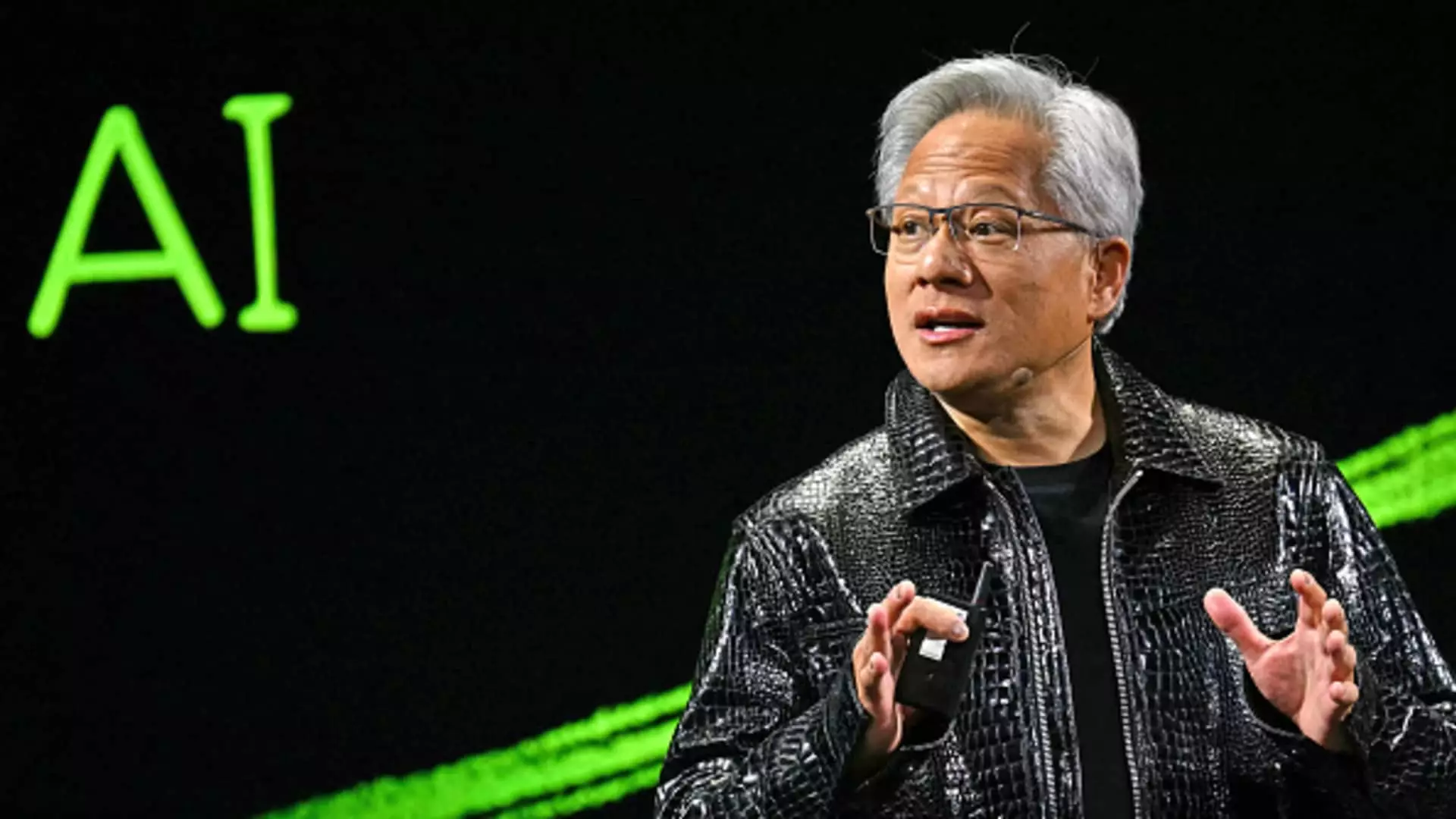

With a compelling year drawing to a close, Nvidia CEO Jensen Huang faces the pressing task of addressing unresolved concerns from stakeholders during the investor call. A significant point of contention revolves around the fiscal discipline of Nvidia’s primary clients—hyperscale cloud companies—who are now exhibiting signs of tightening budgets following a period of robust capital investments. Additionally, rising competition from entities like DeepSeek, a Chinese AI firm, raises critical questions about the demand for Nvidia’s chips in an evolving AI landscape. The competitive narrative propelled by DeepSeek underscores the uncertainty surrounding the necessity for Nvidia’s specialized hardware, stirring investor anxiety regarding future demand.

Moreover, geopolitical tensions are compounded by regulatory scrutiny from U.S. officials contemplating further restrictions on Nvidia’s chip exports to China based on national security grounds. Although Nvidia has already been restricted from supplying its most advanced AI chips to the region, the implications of heightened scrutiny could adversely affect its revenue forecasts and strategic planning.

Throwing another layer into the mix is the rollout of Nvidia’s latest chip architecture, dubbed Blackwell. Reports suggest that distribution might be facing delays due to technical challenges, such as heating and yield issues. The anticipated demand from major players like Microsoft, Google, Oracle, and Amazon paints a picture of dependence on a successful Blackwell launch; investors are keen to monitor developments as supply chain issues could create ripple effects through the already frayed tech landscape.

Given recent reports indicating possible cooling in Microsoft’s infrastructure plans, investors remain on edge, mindful of the company’s substantial $80 billion projected spending on infrastructure in 2025, despite some lingering doubts. Analysts from Morgan Stanley reiterated their confidence in Nvidia, estimating Microsoft’s spending on Blackwell could comprise roughly 35% of the overall market share in 2025. Additionally, major stakeholders like Alphabet and Meta have signaled their commitment to significant capital expenditures, bolstering the notion of sustained investment in AI infrastructure despite temporary setbacks.

With analysts keeping a close watch on Nvidia’s relationship with cloud companies and overall demand for AI chips, the forthcoming earnings report is poised to deliver not only crucial financial insights but also a clearer picture of the future landscape for Nvidia in an increasingly competitive market. Analysts and investors alike are paying close attention to guidance for fiscal 2026, eager to ascertain how Nvidia aims to navigate and stimulate growth in a landscape that is continually evolving.

In essence, Nvidia’s earnings report this Wednesday will not only encapsulate its impressive past year’s performance but will also serve as a barometer for understanding the ongoing interplay between technological advancement, market dynamics, and investor confidence within the realm of artificial intelligence. The insights garnered will likely influence not only Nvidia but also the broader tech market in the months to come.

Leave a Reply

You must be logged in to post a comment.