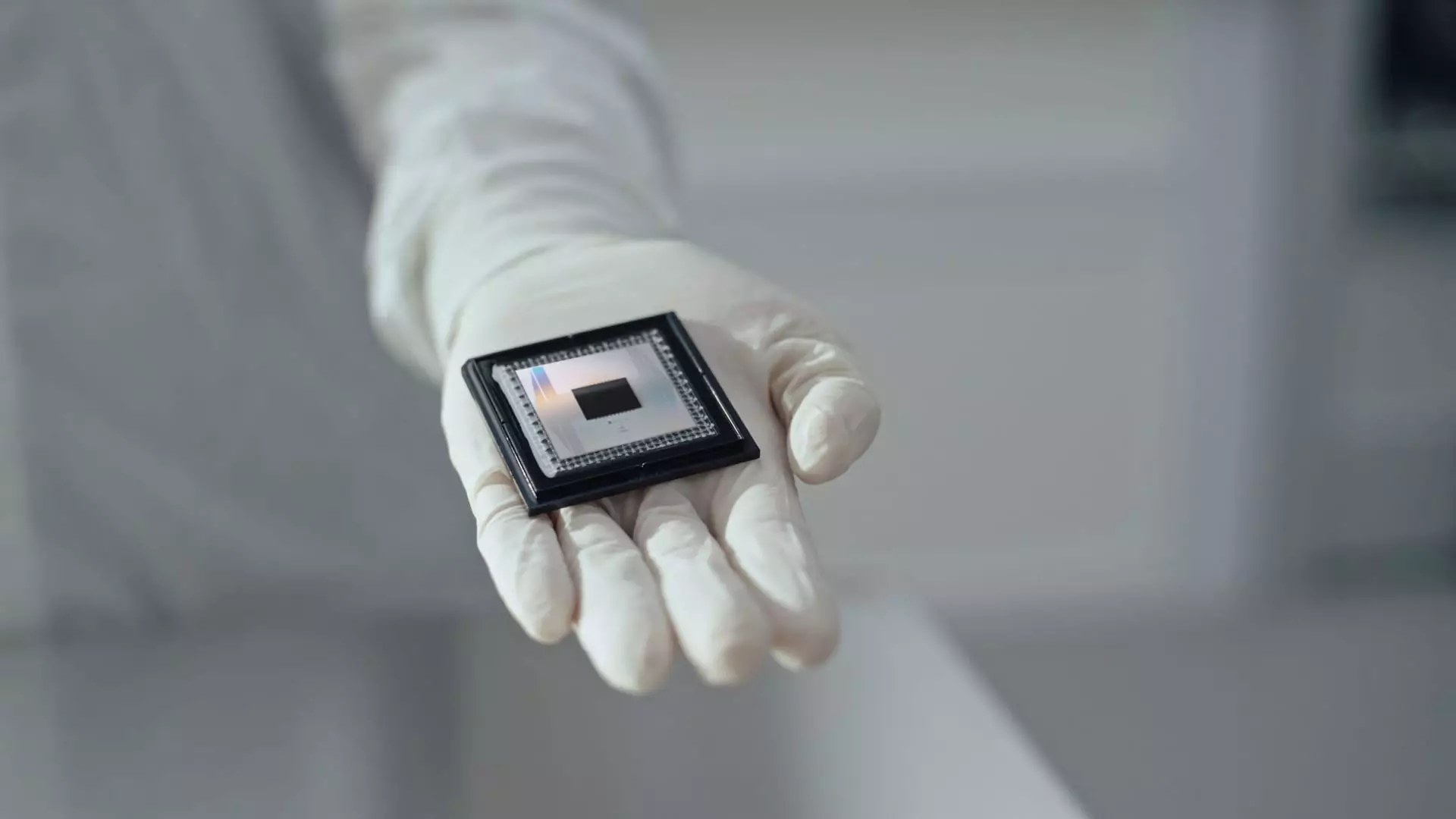

Google’s groundbreaking innovation, the Willow quantum chip, represents a significant leap towards practical quantum computing. This powerful chip reduces the error rates that plagued its predecessors, marking a pivotal moment for the industry and potentially foreshadowing seismic shifts in the world of cryptocurrencies. The calculations showcased by Willow are mind-boggling; it can perform computations in a mere five minutes that would take current supercomputers an unfathomable 10 septillion years. This staggering difference in processing capability invites us to ponder the implications for various sectors, particularly financial technology.

As Willow introduces accuracy alongside its jaw-dropping speed, it raises questions about the security foundations of cryptocurrencies like Bitcoin. Traditionally, the world of quantum computing has been likened to a volatile fountain, with computations leaking in various inaccurate directions. Willow’s improved stability signals that quantum computing is moving closer to a reliable and potent force that could potentially unlock cryptographic algorithms, thereby posing a risk to current digital currencies.

For those uninitiated in the realm of quantum mechanics, the core unit of computation is the qubit. Tim Hollebeek, technology strategist at DigiCert, provides an analogy to simplify this concept. He paints a picture of navigating a maze. While a classical computer would take a systematic, linear approach—trying one path at a time—a quantum computer could evaluate all available options simultaneously. This phenomenon not only sharpens the speed at which problems are solved but also amplifies the challenge of safeguarding our digital assets.

Despite these developments, achieving real-world applications for Willow remains a work in progress. Hollebeek notes that while error correction within qubits has seen considerable enhancements, the concern of quantum computing breaking existing cryptographic systems still resides mainly in the theoretical domain. He emphasizes that even if a quantum computer capable of this breakthrough exists, it is still years away from practical realization. The primary immediacy in the crypto sector, therefore, lies in preparing for long-term adjustments rather than panicking over impending obsolescence.

A representative from Google reiterates that Willow itself does not possess the ability to breach modern cryptography. The concern surrounding the risks quantum computing poses to digital security systems is speculative at this stage. Experts like Park Feierbach, CEO of Radiant Commons, offer additional comfort by asserting that even with the enhanced efficiency of quantum technology, breaking current encryption like RSA would require chronologically impossible time frames, possibly exceeding the age of the universe itself.

This calculated optimism is echoed by experts in the security field who actively develop alternative encryption methods that could withstand quantum onslaughts. The National Institute of Standards and Technology (NIST) is diligently working on quantum-safe algorithms, setting a timeline for industries to integrate these new protocols. Consequently, as we discuss the implications of quantum advancements, it is crucial to highlight the dual path that emerges: on one end, potential vulnerabilities arise; on the other, significant strides in cryptography are in progress.

Industry leaders assert that while there remains a theoretical risk to cryptocurrencies, the practical timeline for such threats is vastly overstated. The potential for quantum capabilities to enhance cryptographic techniques also invites a more constructive dialogue surrounding the future of cryptocurrency security. Not only will quantum computing revolutionize how we understand and deploy algorithms in financial technology, but it also offers the chance to regenerate how we secure this digital landscape.

The advent of quantum-safe cryptocurrencies may very well emerge as new digital assets that inherently incorporate post-quantum cryptographic measures, thus rendering them resistant to future quantum threats. According to Taqi Raza from the University of Massachusetts Amherst, the evolution of these quantum-resistant currencies could diminish the instability currently plaguing existing assets.

Jeremy Allaire, co-founder and CEO of digital currency company Circle, provides a balanced perspective by summarizing the duality of the quantum discourse. He argues that quantum computing will not merely expose vulnerabilities but could also stimulate a phase of innovation within the sector. By enhancing the very foundations of digital security, “quantum crypto” could usher in a new standard of protection that ultimately benefits users and systems alike.

While the focus on cryptocurrency is valid, it is essential to cast a wider net to encompass the broader ramifications of quantum advancements. The transformative potential of quantum computing lies not solely within the realm of finance but extends across various sectors. From healthcare innovations to energy optimization, the implications of quantum efficacy will likely permeate multiple layers of modern life.

Experts, including Raza, envision a future not just defined by cryptocurrency but one where enhanced computing capabilities catalyze extensive societal transformation. The interconnectedness of quantum innovations could reshape industries starting from security to artificial intelligence, fundamentally altering the trajectory of technological growth. As these advancements progress, it is crucial to prepare not only for immediate changes in crypto regulation but also for the broader reinvention of our interaction with technology itself.

While the arrival of Willow is a noteworthy milestone, it serves as a precursor to a future where quantum computing’s challenges and opportunities unfold, demanding both vigilance and innovation from stakeholders across all domains.

Leave a Reply

You must be logged in to post a comment.