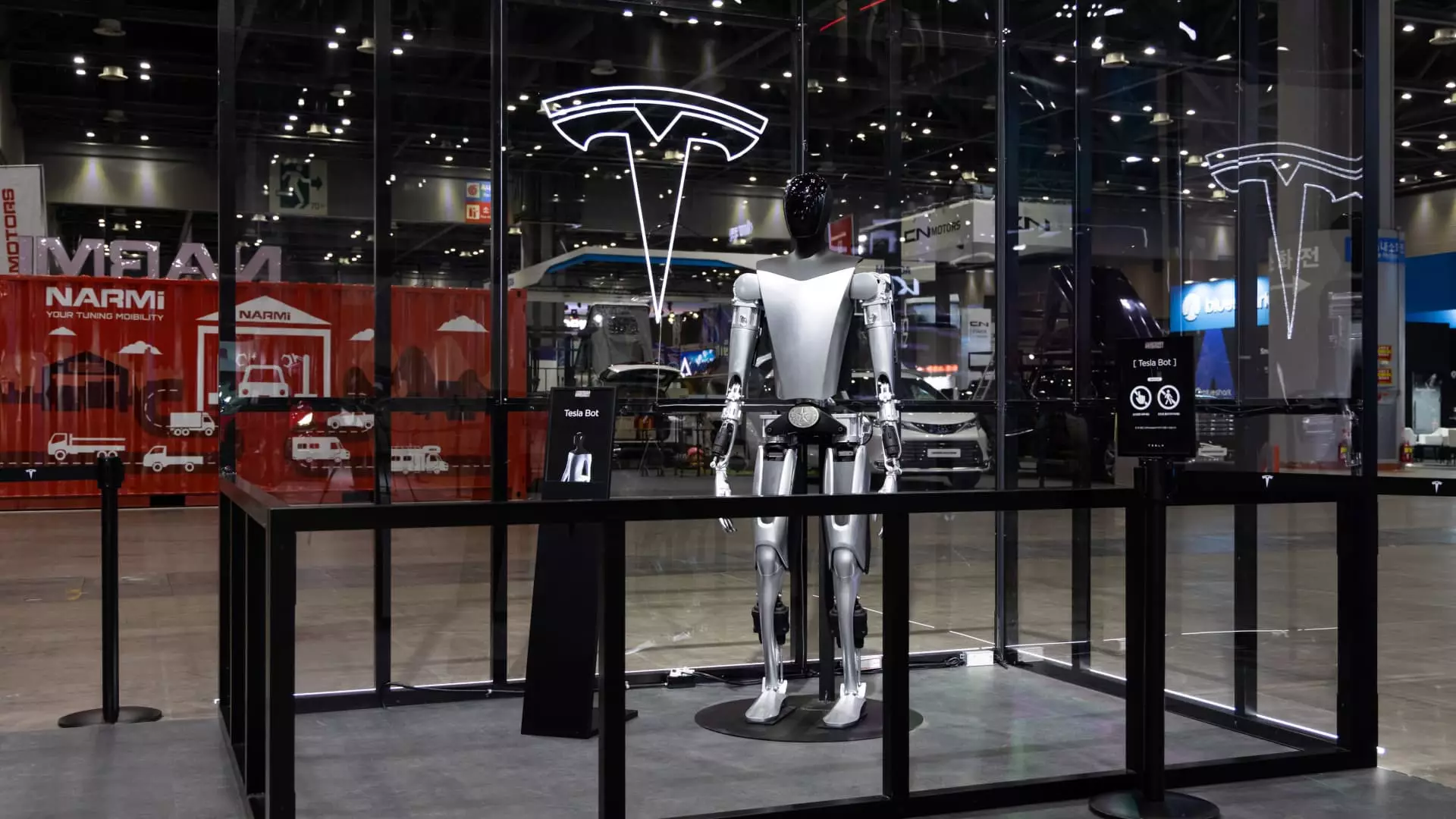

Elon Musk, the CEO of Tesla, is known for his ambitious visions and bold statements. At the 2024 annual shareholder meeting, he introduced the concept of Optimus humanoid robots and claimed that they could potentially boost Tesla’s market cap to $25 trillion. This announcement comes as part of a larger narrative of Tesla entering a new era, where Optimus robots will play a significant role.

Despite Musk’s grand promises, there are doubts about the current capabilities of Optimus robots. When initially revealed in 2021, the demonstration of humanoid robots folding laundry was criticized for being deceptive, as they were not autonomous and operated by humans. Musk hinted at a future where these robots could perform a wide range of tasks, from cooking to factory work. However, the exact capabilities of Optimus today remain unclear.

Tesla’s journey towards a $25 trillion market cap is filled with challenges and uncertainties. Musk’s track record of making ambitious promises that often fall short raises concerns among investors and industry analysts. The aggressive timeline of producing “limited production” of Optimus robots in 2025 and deploying thousands of them in Tesla factories sounds ambitious, even for Musk.

One of the key concerns surrounding Elon Musk is his involvement in multiple ventures, including Tesla, SpaceX, The Boring Co., Neuralink, and xAI. Balancing his commitments across these companies while driving innovation and growth in each of them raises questions about his ability to focus on Tesla’s ambitious goals. Despite his claim of being a “helpful accelerant” to Tesla’s future, his wide array of projects may impact his effectiveness in steering the company towards success.

While Musk envisions Optimus robots as a game-changer for Tesla’s future, he faces stiff competition from other companies and startups in the robotics space. Players like Boston Dynamics, Agility, Neura, and Apptronik are also investing in humanoid robots with advanced capabilities. Musk’s emphasis on being faster and better than competitors reflects the competitive nature of the robotics market.

Tesla’s stock performance has been volatile, with a 27% decline this year attributed to sales challenges and increased competition. Musk’s reassurance to investors to focus on the company’s future prospects in autonomous driving, robots, and AI may not be enough to overcome the current concerns about Tesla’s business operations. The market’s reaction to Musk’s ambitious claims and the reinstatement of his controversial pay plan signals a mixed sentiment among investors.

Elon Musk’s vision of Optimus robots shaping Tesla’s future and propelling its market cap to $25 trillion is met with skepticism and uncertainty. While Musk’s optimism and bold predictions have fueled excitement among Tesla enthusiasts, the practical challenges of delivering on these promises remain significant. The road ahead for Tesla is paved with obstacles, including competition, market dynamics, and Musk’s own diverse portfolio of ventures. Only time will tell if Musk’s vision will materialize into reality or remain a lofty aspiration for the electric car maker.

Leave a Reply

You must be logged in to post a comment.