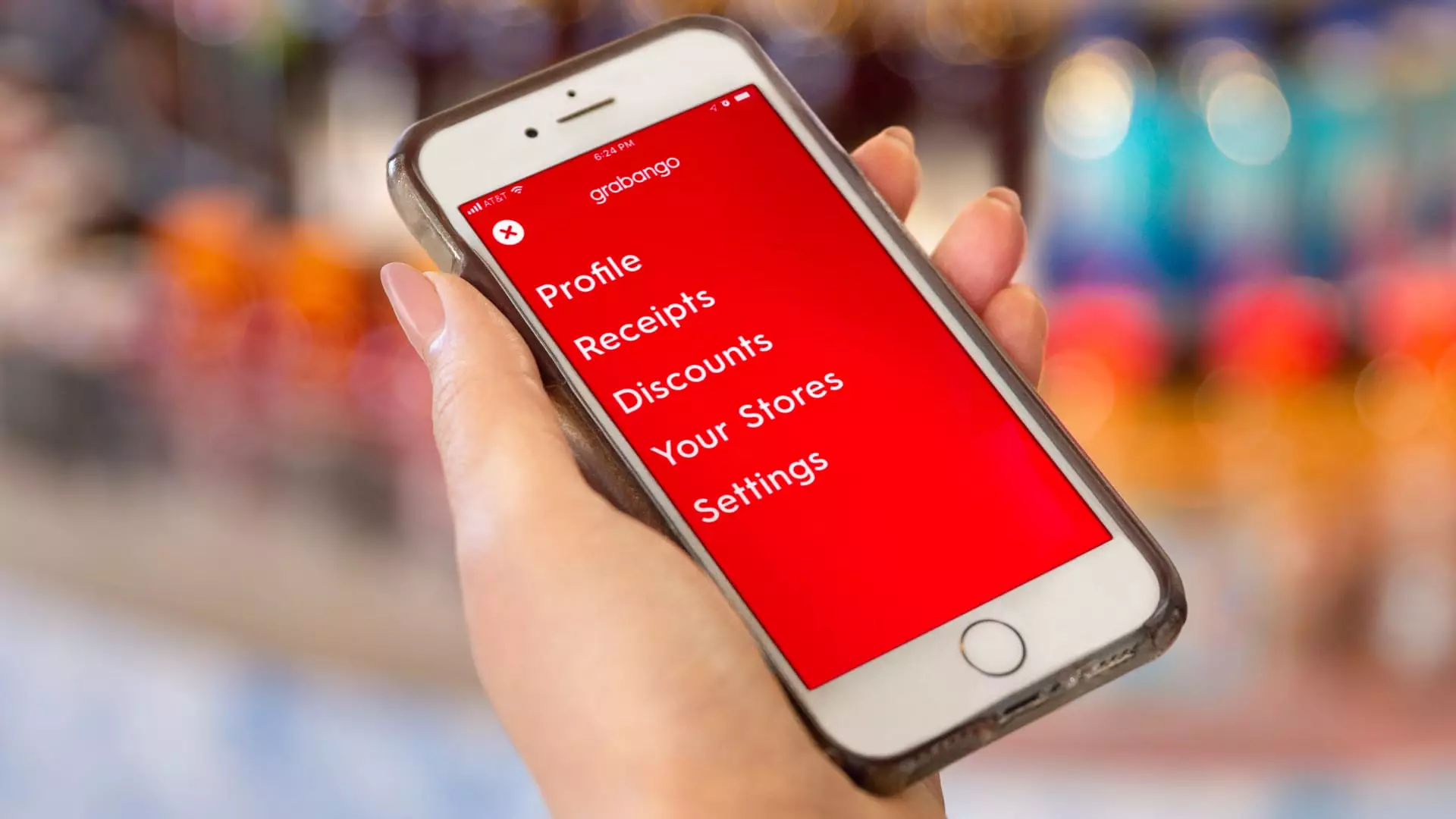

Founded in 2016 by Will Glaser, an influential figure in the tech landscape known for his role as a co-founder of Pandora, Grabango sought to revolutionize the grocery shopping experience with its innovative cashierless checkout technology. By leveraging advanced computer vision and machine learning algorithms, Grabango aimed to create a system that would allow customers to simply grab items from shelves and walk out of the store without the usual checkout process. The appeal was significant; as consumers increasingly sought convenience, Grabango positioned itself as a formidable competitor to giants like Amazon’s Just Walk Out service.

The Funding Struggles

Despite establishing a robust technological foundation and securing around $73 million in funding, Grabango ultimately encountered insurmountable financial obstacles as it endeavored to grow and sustain its operations. The company’s most substantial funding round occurred in June 2021, which raised $39 million, but this cash infusion proved insufficient in the long run. By 2022, Grabango’s attempts to attract further investment coincided with a broader downturn in the tech sector. The initial excitement surrounding tech innovations yielded to a chilling market environment where venture capital firms became increasingly reticent to commit to new projects.

In February of this year, Glaser expressed aspirations of taking the company public at an estimated market cap between $10 billion and $15 billion, a dream that quickly frayed amid tightening financial conditions. The venture-backed IPO landscape in the U.S. had drastically shifted, with very few companies successfully seeing a public debut. This shift underscored the broader challenges faced by startups across various sectors, particularly those outside of the dominating AI trend.

Grabango was not alone in its pursuit of cashierless checkout technology. Competitors such as AiFi and Trigo emerged, aiming to capture a share of the growing demand for seamless shopping experiences. These companies often found themselves in a fierce rivalry with Amazon, which already had the resources to implement its cashierless technology in multiple venues, including convenience stores and airports. Moreover, Amazon’s Just Walk Out system had gained traction despite earlier setbacks in the company’s own Fresh and Whole Foods stores.

Glaser critiqued Amazon’s approach, suggesting that the reliance on shelf sensor technology could be a “fatal flaw” in its system. He advocated for a strategy centered around computer vision, which he claimed would offer a more reliable solution. However, Grabango’s lack of sufficient funding limited its ability to promote this competitive edge, and the subsequent shut-down of operations left customers and partners in the lurch.

The closure of Grabango is not just a narrative of a failed startup; it serves as a cautionary tale regarding the volatility of the technology sector. The company had substantial potential but ultimately could not navigate the complexities of funding and competition within a challenging market space. It also highlights the vulnerabilities faced by companies heavily reliant on external funding, particularly when the economic landscape shifts dramatically.

Moreover, the story prompts a critical examination of the innovation cycle in tech industries. Will Glaser’s emphasis on learning from competitors suggests an important lesson; even innovative ideas can falter without the accompanying financial footing and strategic foresight necessary for successful scaling.

As the dust settles on Grabango’s closure, the future of cashierless technology remains uncertain but filled with possibilities. Other players in the space may still thrive, driven by evolving consumer preferences for convenience and a desire for frictionless shopping experiences. Nonetheless, startups must remain vigilant, as the path to innovation is fraught with challenges that require a combination of technology, appropriate funding, and market readiness. Grabango’s trajectory from a promising startup to an unfortunate shutdown encapsulates the unpredictable nature of entrepreneurship in the tech realm, where success often hinges on a delicate balance of innovation and financial resilience.

Leave a Reply

You must be logged in to post a comment.