In a move that caught many analysts off guard, President Donald Trump has retreated from imposing tariffs on electronics, a decision that shines a light on the tenuous relationship between trade policy and technological advancement. This unexpected pivot comes as the stock market grapples with significant fluctuations, which have seen a staggering 15% decline since Trump’s inauguration. The reversal specifically exempts a range of consumer electronics from heavy tariffs, including vital semiconductors, a core component in nearly every electronic device. With much of this manufacturing currently concentrated in China, this decision reflects a broader understanding of the potential economic repercussions that could arise from escalating trade tensions.

It is crucial to recognize that tariffs, at their essence, are a tax on consumers. By lifting these tariffs, Trump seems to acknowledge the type of backlash that could arise from skyrocketing prices—predicted to hit exorbitant levels for everyday electronics that Americans rely on. For instance, an iPhone that might cost $1,000 could theoretically escalate to over $3,500 if manufactured domestically under such punitive measures. Yet, it must be noted that simply pulling back on tariffs does not automatically mend investor confidence. The arbitrary nature with which Trump has navigated trade relations poses a cloud of uncertainty that impacts market behavior far more than any singular policy.

Effects on the Consumer Electronics Market

The implications of these tariff exemptions extend beyond simple price reduction. The Consumer Technology Association has warned consumers could see price hikes of up to 46% for laptops or 40% for game consoles if these tariffs prevailed. This is indicative of the larger reality: unchecked tariffs could cripple an economy heavily reliant on affordable technology. While the lifting of tariffs may offer temporary relief to companies like Apple, the notion of American manufacturing being exclusively focused on high-tech products remains more aspirational than realistic at this moment.

The notion that the U.S. could reclaim significant market share in chip production overlooks decades of complex developments in global supply chains that have led to our current situation. Companies such as Taiwan’s TSMC have established themselves as industry leaders, leveraging factors like scale and innovation that the U.S. has not been able to match. Scott Almassy from PwC rightly pointed out the essential need for raw materials and commodities to create a solid manufacturing foundation. In other words, it is not simply a matter of implementing tariffs; a more intricate strategy is necessary to enable the U.S. to reclaim technological supremacy.

The Reality of Domestic Manufacturing Challenges

Trump’s administration has hinted at the long-term vision for American tech manufacturing through initiatives like the bipartisan U.S. Chips and Science Act, yet promises of a renaissance in domestic chip production are fraught with complications. As insights from Deloitte reveal, even with significant financial backing, bringing manufacturing back to the U.S. is an arduous, multi-decade endeavor that is only likely to yield marginal increases in market share by 2032.

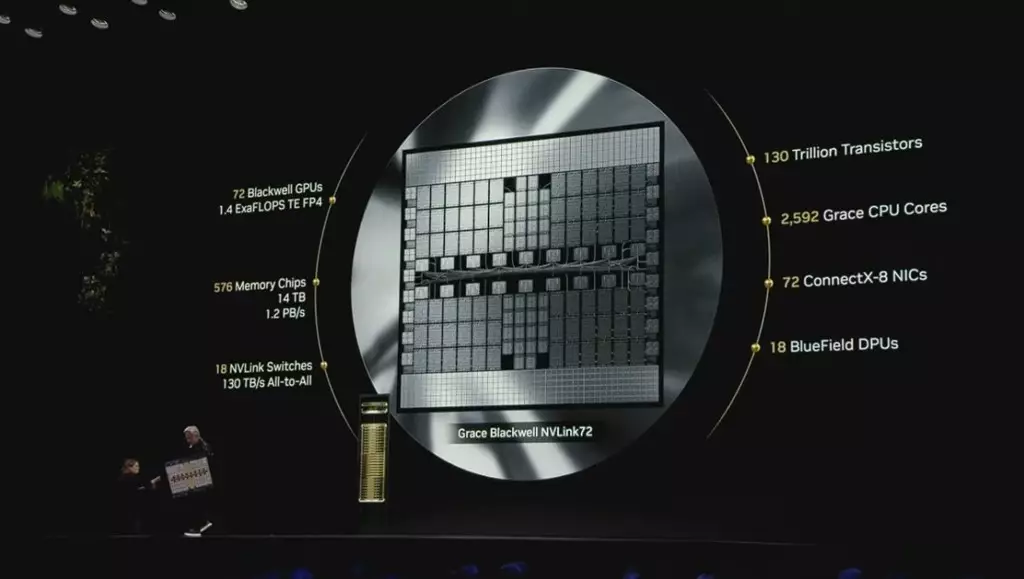

The timeline is not the only barrier; the fundamental shift in market dynamics must be addressed. As seen with the success of companies like Nvidia, innovation in chip design can often be more critical than merely establishing domestic factories. By outsourcing fabrication to facilities such as those operated by TSMC, Nvidia has outpaced traditional giants like Intel by leveraging advancements in processing power and innovative technologies like artificial intelligence (AI).

The complexities of supply chains further emphasize that restoring American manufacturing is as much about educating a skilled workforce as it is about building facilities. Unfortunately, our educational system lags behind global competitors, particularly in science and mathematics, resulting in a shortage of qualified engineers who can drive future technological breakthroughs. With countries like China producing far more engineers annually, the challenge is not solely about where to assemble products but who will engineer and innovate them.

Lobbying Influence and the Path Forward

The tension between technological innovation and political maneuvering is palpable as the tech industry increasingly seeks to influence policy. While some may raise alarms about the lobbying clout wielded by major tech firms, it is undeniable that they serve to cultivate high-value jobs essential for a modern economy. This emerging landscape requires a workforce equipped with advanced skills and education, something a significant portion of the current U.S. labor market lacks.

Trump’s spokesperson emphatically reasserts the administration’s commitment to reducing reliance on foreign countries for crucial technologies, echoing sentiments about the necessity of onshoring manufacturing. However, the effectiveness of tariffs alone in remedying the trade imbalance with China remains deeply questionable. Beyond tariffs, a comprehensive strategy that emphasizes innovation, education, and international cooperation will be essential for the U.S. to regain its footing in the global tech landscape.

The convolution of today’s tech economy underscores the complexities faced by policymakers striving for reform while seeking to foster a competitive edge. Without an integrated approach that encompasses the vagaries of the supply chain and workforce development, merely reversing tariffs may not be enough to secure America’s place as a leader in technology. The future may be bright, but only if we take a holistic view of the challenges ahead.

Leave a Reply

You must be logged in to post a comment.