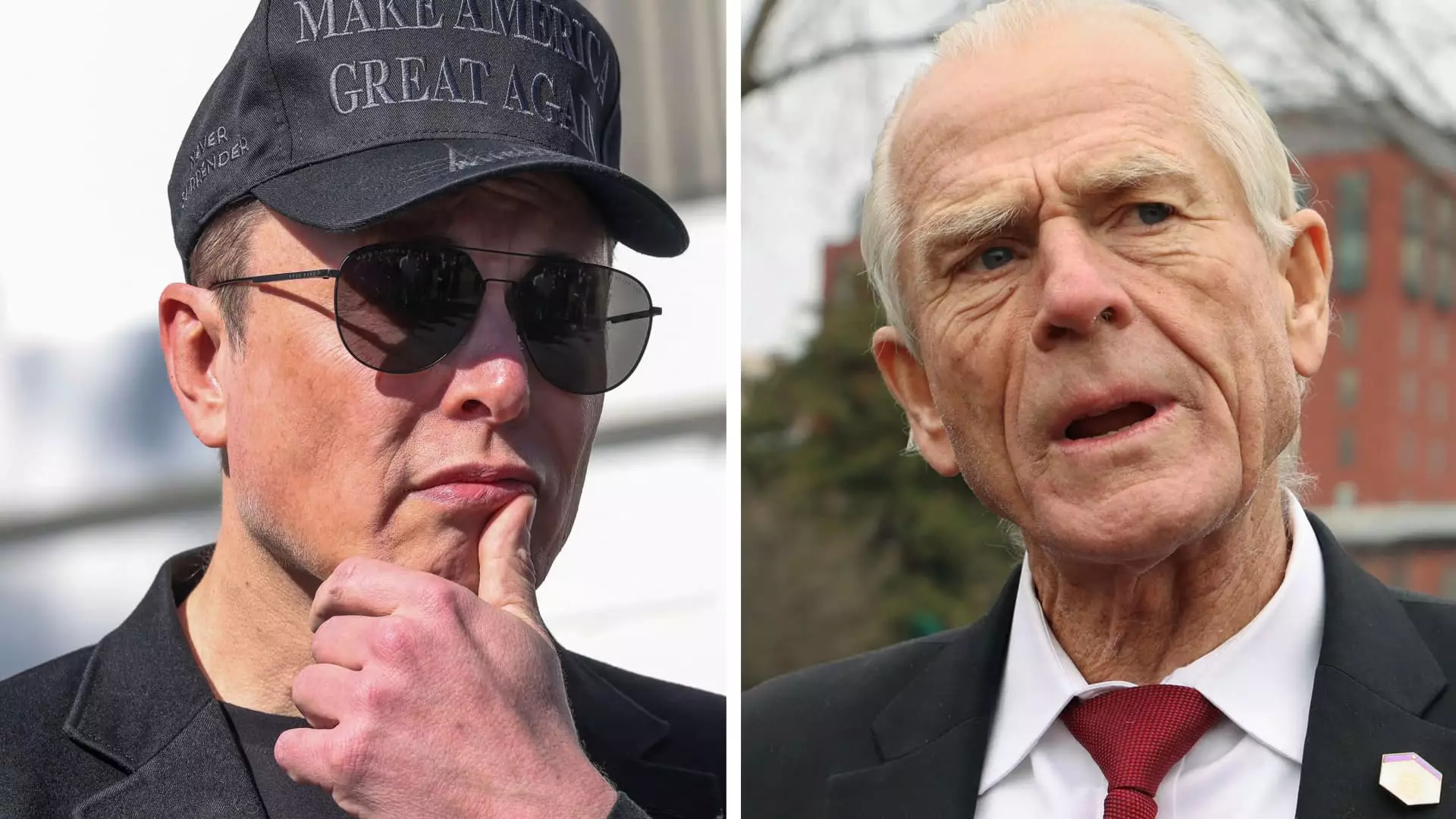

In a remarkable incident that exemplifies the volatility of today’s political and economic landscape, Tesla CEO Elon Musk has publicly clashed with Peter Navarro, a prominent trade advisor under former President Donald Trump. This feud, characterized by Musk’s acerbic tweets and Navarro’s contentious remarks, unfolds against a backdrop of significant stock depreciation for Tesla. As the company grapples with a staggering 22% decline in its share price over the past week alone, Musk’s barbs against Navarro reflect not just personal animosity, but a profound challenge facing Tesla in the wider economic context.

Musk’s attack on Navarro, which began with a scathing reassessment of the latter’s PhD credentials, quickly escalated to claims that Navarro is “truly a moron” and “dangerously dumb.” The severity of Musk’s comments is both intriguing and troubling, revealing a man under pressure who is unafraid to air his grievances in public. This kind of rhetoric, while engaging, raises questions about the implications of such outbursts on investor confidence. Notably, the exchange is emblematic of a broader deterioration in the civility of discourse among corporate leaders and government officials.

The Underpinnings of the Tension

Much of this animosity can be traced back to Navarro’s assertion that Tesla is merely a “car assembler,” a comment Musk vehemently disputes. He argues that Navarro’s characterization overlooks the intricate engineering and innovation that Tesla embodies. This spat, while personal, echoes larger concerns about U.S. trade policy—specifically, the tariffs imposed by the Trump administration that impact not only Tesla’s production costs but also its global strategy.

Critics, including Musk, have noted that the tariffs on materials sourced from abroad, particularly steel and aluminum, pose a looming threat to Tesla’s operations. This financial pressure is not just a nuisance; it potentially complicates Tesla’s ability to maintain its edge in the increasingly competitive electric vehicle market. With the company’s stock valuation plummeting by over $585 billion since January, Musk is not just defending his company’s reputation, but also its financial viability.

Political and Corporate Ramifications

The power dynamics at play in this public feud go beyond individual grievances; they highlight a division within the Trump administration regarding trade policies. White House spokesperson Karoline Leavitt’s dismissal of the feud as a minor kerfuffle underscores this tension. Yet the stakes are high: Musk’s fortune is deeply interwoven with the performance of Tesla, and public spats like this can lead to unpredictable outcomes in the stock market. The administration’s conflicting viewpoints suggest a lack of unified strategy that could hurt companies heavily reliant on international trade.

Furthermore, Musk’s call for the United States and Europe to adopt a zero-tariff framework illuminates not only his vision for free trade but also his interests vested in European markets through Tesla’s extensive manufacturing operations in Berlin. This is a stark contrast to the administration’s protectionist stance, presenting a dichotomy that places Musk in direct opposition to the prevailing policies.

The Aftermath of Declining Performance

As Tesla struggles with declining deliveries and stagnating growth—evidenced by a reported 13% year-over-year drop in the first quarter—the impact of political machinations becomes increasingly clear. The juxtaposition of Musk’s aggressive engagement with Navarro and the company’s faltering results brings to light a mismatch between grand ambitions and harsh realities. The resulting situation is a precarious one, creating an environment ripe for dissent among shareholders and employees alike, as protests and boycotts of Tesla increase.

This tumultuous time has also seen Musk embrace a role at the helm of the Department of Government Efficiency, where he has made drastic budget cuts, and reduced regulations in an attempt to restore order within the complex machinery of federal interactions. However, this approach may inadvertently exacerbate the corporate tensions surrounding Tesla, as Musk’s political affiliations come under scrutiny.

Ultimately, Musk’s foray into public confrontation with Navarro encapsulates an era where corporate leaders feel empowered to engage in partisan politics. However, the question remains: at what cost does this bravado come to the companies they lead? As Tesla navigates its own crisis of identity and valuation, the intersection of business acumen, political maneuvering, and public perception will determine its future trajectory more than ever before.

Leave a Reply

You must be logged in to post a comment.